Mutual funds and exchange-traded funds (ETFs) are two of the more commonly used investment products, particularly in retirement funds. They’re similar in function but have a few key differences. We use both in our investing strategies, so let’s take a look at how they work and the best uses for each.

Both mutual funds and ETFs pool investor money to buy or track various securities — things like stocks bonds or even real estate. When you invest in either, you gain exposure to the assets in, or tracked by, the fund.

In other words, by investing in a single fund, you generally gain exposure to a wider array of investments than if you bought a single stock or bond.

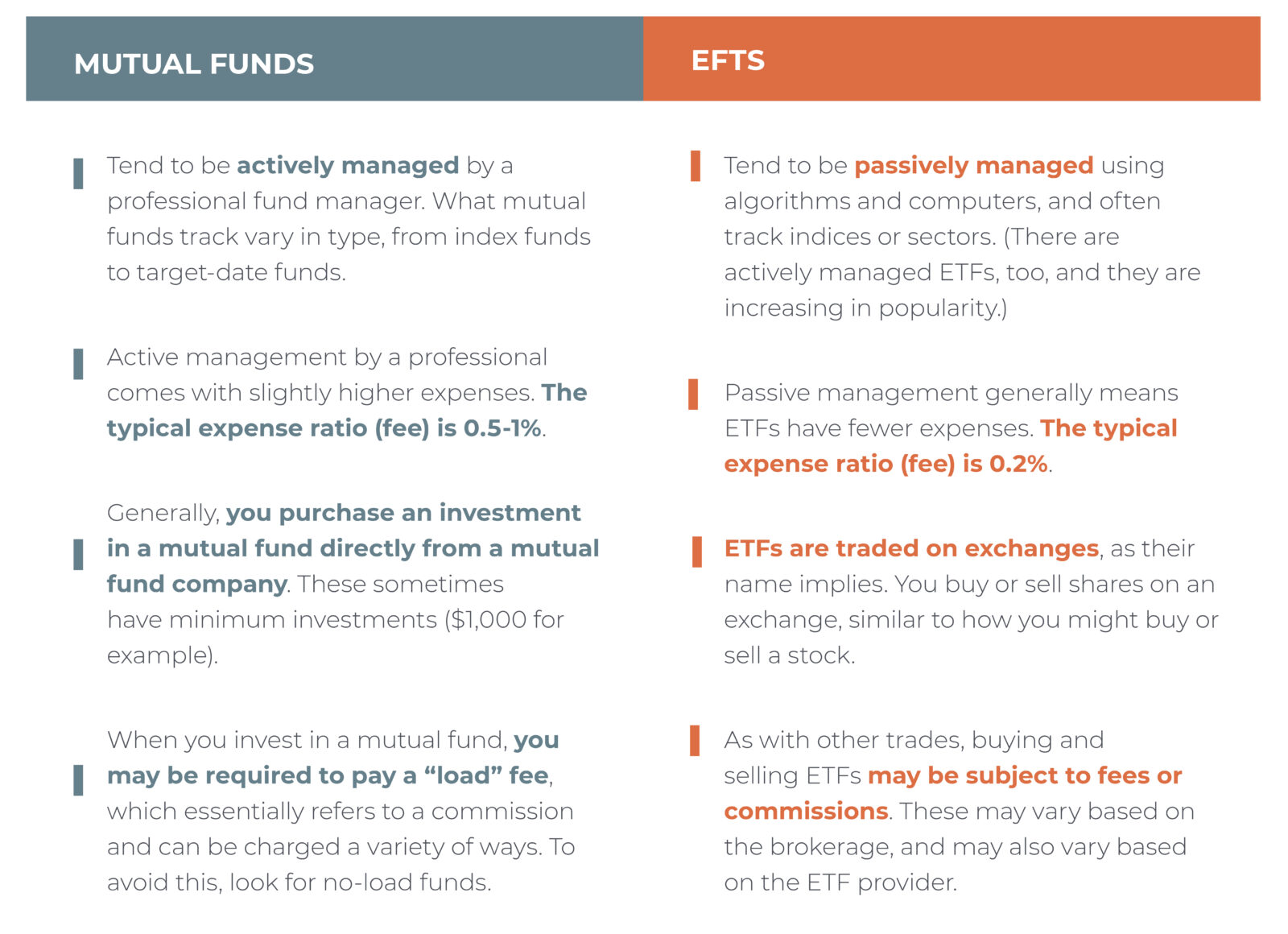

Now, let’s consider some of the differences between the two.

Overall, the industry is moving more towards ETFs, since mutual funds can be harder to invest in and have higher initial costs. Still, with the growing popularity of ETFs, we’re starting to see more “actively managed” ETFs, which can carry higher fees than the more traditional, passively managed ETFs. If you’re choosing investments in a 401(k) or other self-directed account, be sure to compare these details, which can usually be found in the fund’s prospectus. For all other investments, we do this research for you.

So how do we choose between the two? We tend to use ETFs for the passive part of client portfolios — for instance, we might use an index that tracks the S&P 500®.

Of course, there are also your personal goals and risks to consider. And different strategies work best depending on these factors. That’s why we generally use both ETFs and mutual funds when creating client portfolios.

Sources: MorningStar

Investing in mutual funds involves risk, including possible loss of principal. Fund value will fluctuate with market conditions and it may not achieve its investment objective.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value, and may trade at prices above or below the ETF’s net asset value (NAV). Upon redemption, the value of fund shares may be worth more or less than their original cost. ETFs carry additional risks such as not being diversified, possible trading halts, and index tracking errors.