When you’re building a portfolio of investments, it’s important to make sure it’s diverse. We’ll explain why that is in detail, but first, let’s make sure we’re on the same page about what diversification means in the context of investing. Diversity in a portfolio has the same meaning as diversity elsewhere: It refers to a variety of investments.

How can we make sure your investments are diverse? To start, we categorize types of investments. At the highest level, you have asset classes. Simply put, these are the types of assets you own — stocks, bonds, real estate, commodities.

Go down a layer, and you see there are groupings within an asset class, as well. With stocks, you have categories of stocks, like growth or dividend. You can also group stocks according to their industry — tech stocks, financials, industrial stocks — or by their size — large-cap, small-cap, and so on. You can categorize bonds by issuer, for instance, government bonds (issued by the Treasury Department) or corporate debt issued by companies. You could also categorize bonds by their rating or risk level.

A truly diverse portfolio is invested in a diverse array of asset classes and holds diverse investments within those asset classes. Let’s take a closer look.

How diversification works

At the highest level, you want to invest in a wide variety of asset classes. That means it’s better to invest in both stocks and bonds than to invest in stocks alone.

There’s a reason for this. Investments respond differently to stimuli. Consider a sudden thunderstorm: bad for the local pool, good for umbrella sales. If you only own stock in the local pool, the thunderstorm is probably bad for your investment. But if you own stock in the umbrella company, too, the negative effect of the thunderstorm on the pool is likely going to be offset to some degree by an uptick in positive umbrella sales.

This same principle applies at scale. Stocks and bonds tend to perform differently and react to different things. Their performance isn’t generally correlated.

That means if there’s a big dip in the stock market, having part of your portfolio in bonds can help protect you from that dip. On the other hand, if you’re largely invested in bonds and interest rates are low, having part of your portfolio in stocks can help prevent your portfolio from stagnating.

Next, we go down a layer and think about how to diversify within an asset class. Let’s use stocks as an example and consider a tech-savvy investor in the 90s.

Suppose our investor believes the worldwide web is the future of global business and goes all-in on tech stocks. Following the tech bubble burst, our investor was probably in bad shape. If she had diversified beyond tech stocks, however, she would have been in better shape. Say her portfolio included banks, retailers, pharmaceutical companies, and energy stocks, too. That’s four other industries to help balance out what’s happening in tech.

But let’s go one layer further. Even if our investor had stocks from various industries in her portfolio, suppose she invested only in U.S. companies. This is common — many investors build and prefer home-based portfolios. However, from 1999 to 2009, the U.S. stock market was largely stagnant. So much so that it’s been dubbed “the lost decade” for stocks. If our investor had invested in global companies in addition to U.S. companies, she may have seen more growth.

The same applies to bonds. If you had invested solely in 10-year U.S. treasuries, the extended period of historically low-interest rates would have had a much bigger impact than if you also owned corporate bonds, municipal (muni) bonds, or bonds from other countries.

The diversification effect

So how exactly can diversification help your portfolio … and by how much?

According to one study by investment firm MorningStar, going from one type of investment to four different types of investments can reduce volatility in a portfolio by 50%. Volatility refers to big swings up and down, so less volatility can help with managing risk. Plus, a little bit of diversification goes a long way; research shows that after a certain point, the benefit of adding new types of investments starts to diminish.

We look at how different types of investments have performed historically to try and get a sense of how correlated they are. While past performance doesn’t predict future results, it can help us assess how your portfolio might respond to certain events, like a rate hike or a correction in the stock market.

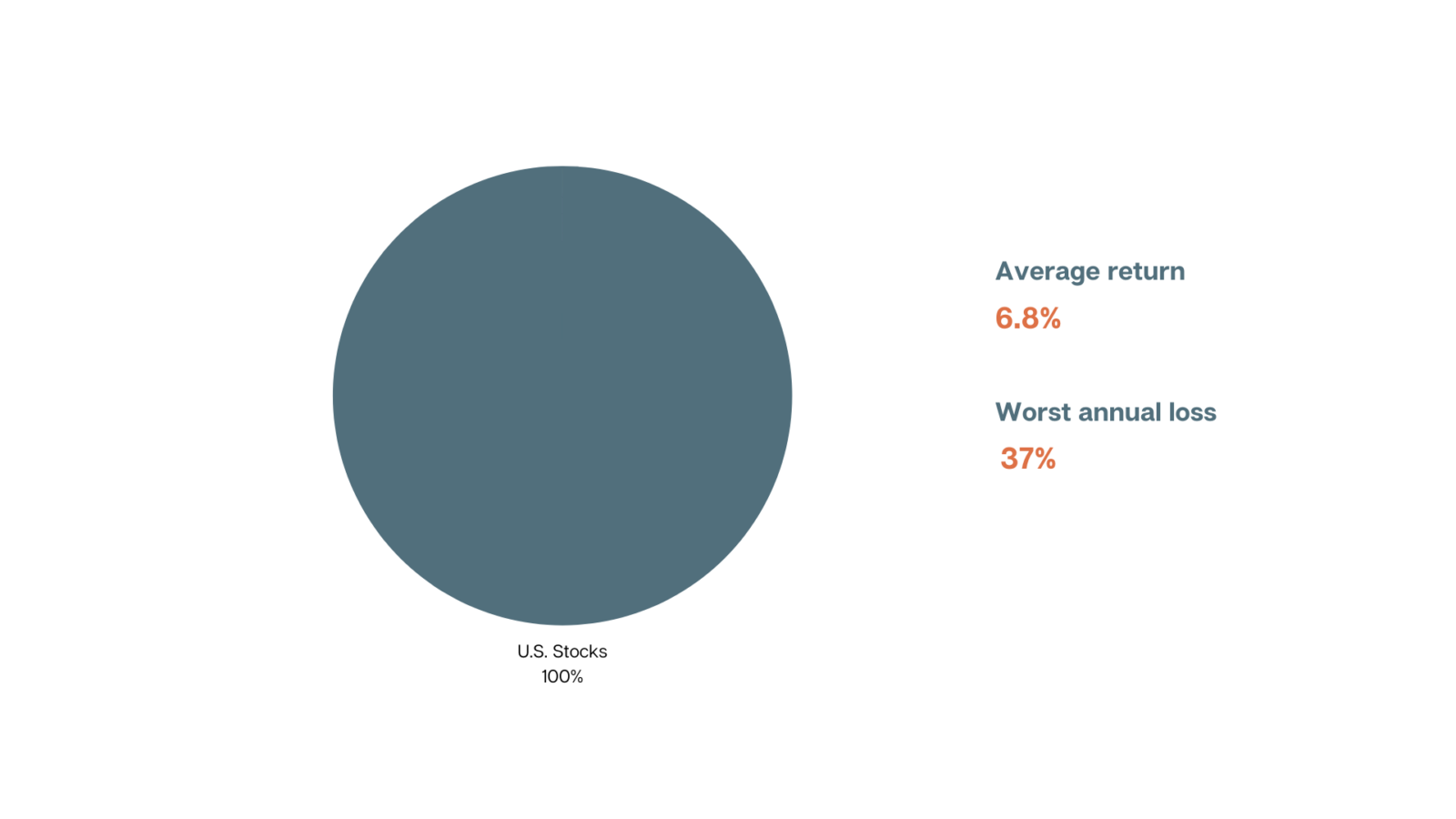

For instance, consider the chart below, which we built using MorningStar data. If you were invested in only U.S. stocks from 1998 to 2018, your money would have returned just under 7% on average. But for one calendar year, your portfolio was down 37%, which is hard for any investor to stomach.

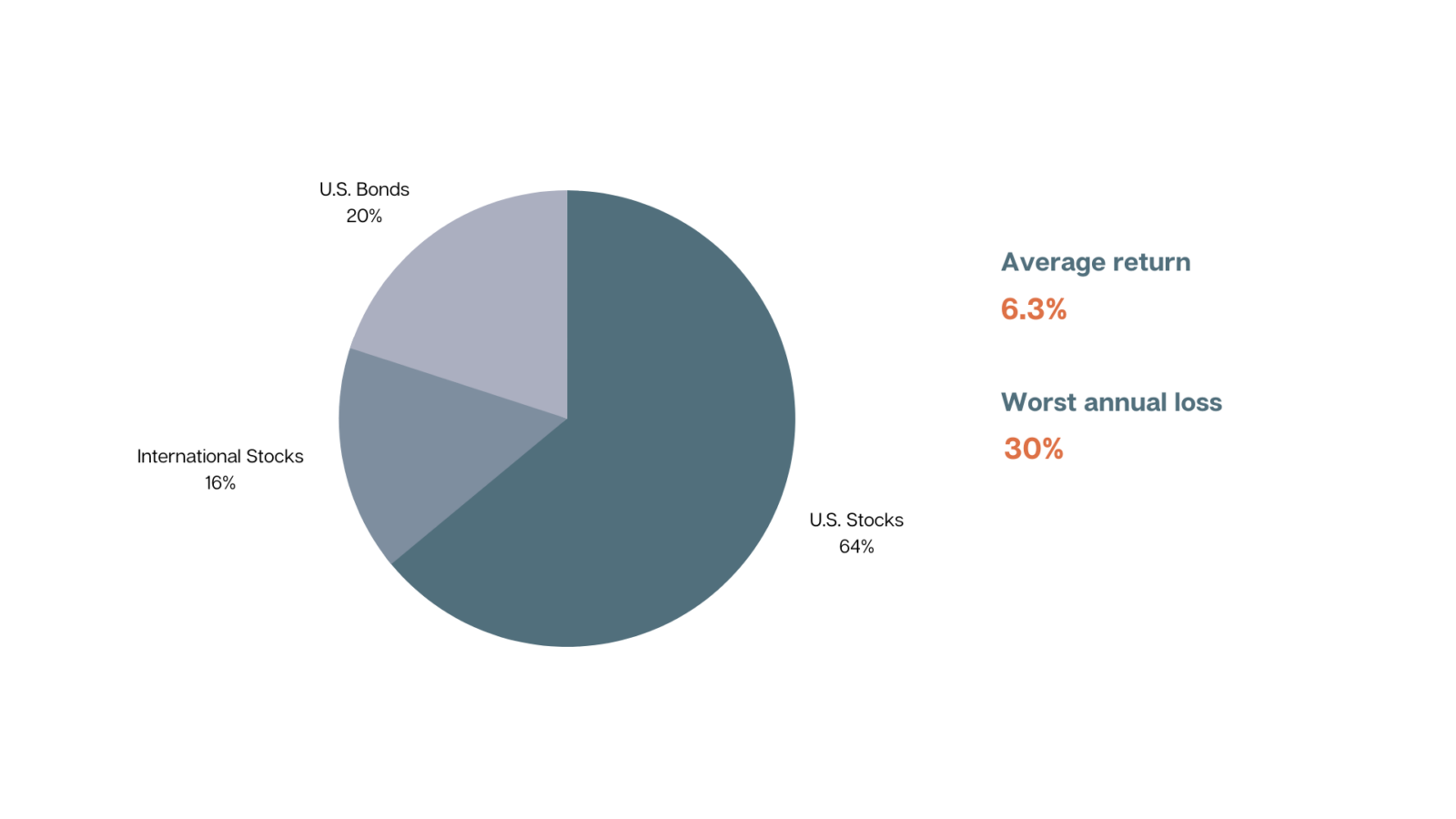

Now, imagine that same time period but with a diversified portfolio: 20% in U.S. bonds, and 16% in international stocks. The rest (64%) is in U.S. stocks. By adding this diversification, your worst year is now a loss of 30% — still significant but less jarring than 37%. Meanwhile, you haven’t compromised too much on returns.

It’s important to note that the diversified portfolio doesn’t protect the investor from loss, especially if you end up with a systemic, global event like the 2008 financial crisis. It does, however, smooth the potential impact of big events and helps insulate you from targeted risk. In both cases, the goal is to help your portfolio recover faster.

The best way to diversify is to find assets that are not correlated, like a swimming pool and an umbrella manufacturer. Often, it isn’t quite as simple as stocks and bonds. For instance, higher interest rates tend to negatively impact the stock market, since it makes it more expensive to borrow money and fuel growth. Banks, on the other hand, tend to make more money when rates are higher; they aren’t totally correlated with the rest of the market.

When determining how to diversify portfolios, we tend to look at your goals and risk tolerance and consider a version of the table above. While every portfolio is different, the goal is to find the right diversification to get you to your goals with the least amount of risk.

If you have questions about diversification in your portfolio, let’s discuss them at our next meeting.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.